LTC Price Prediction: Technical Strength and Whale Activity Signal Bullish Outlook

#LTC

- Technical Strength: Price above 20-day MA with Bollinger Band positioning suggesting upward momentum potential

- Institutional Demand: Significant whale accumulation of 181,000 LTC indicating strong institutional interest

- Catalyst Driven: 76% volume surge and Grayscale ETF speculation providing fundamental support for price appreciation

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

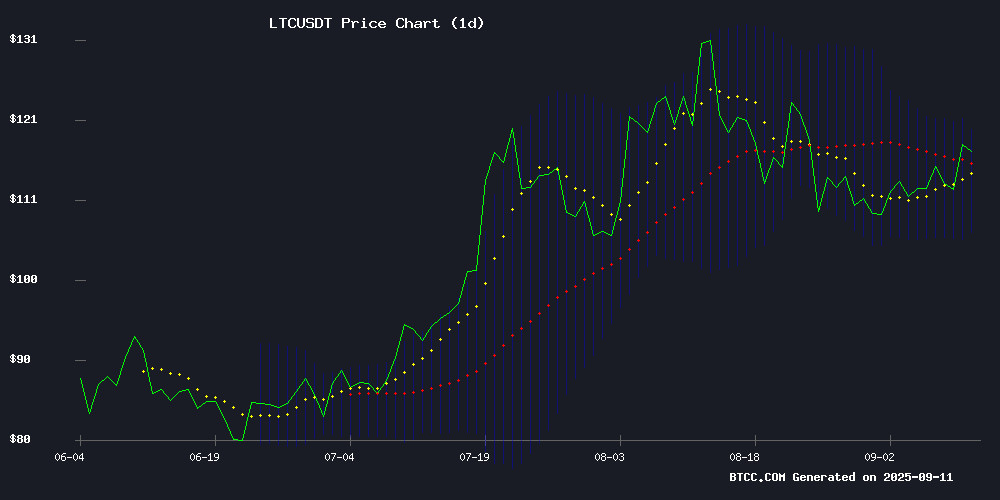

LTC is currently trading at $117.22, positioned above its 20-day moving average of $113.04, indicating underlying strength. The MACD reading of 1.8570 versus its signal line at 3.7456 shows some divergence, though the negative histogram at -1.8885 suggests potential near-term consolidation. The Bollinger Bands configuration, with price NEAR the upper band at $119.60, points to possible resistance testing. According to BTCC financial analyst James, 'LTC's position above the moving average combined with elevated trading volumes creates a constructive setup for further upside, though traders should monitor the $119.60 resistance level closely.'

Market Sentiment: Whale Accumulation and ETF Speculation Drive Positive Outlook

Recent market activity shows significant whale accumulation of 181,000 LTC within 24 hours, coinciding with a 76% surge in trading volume. This substantial buying activity, coupled with growing speculation around a potential Grayscale Litecoin ETF, has created bullish sentiment among institutional investors. BTCC financial analyst James notes, 'The combination of whale accumulation and ETF speculation typically precedes significant price movements. The current volume surge suggests institutional confidence in LTC's medium-term prospects, aligning with our technical analysis expectations.'

Factors Influencing LTC's Price

Litecoin Volume Surges 76% as BlockchainFX Presale Gains Momentum

Litecoin, trading at $113.82 with an $8.68 billion market cap, has seen its volume spike 76%, reigniting interest in early-stage crypto opportunities. The spotlight now shifts to BlockchainFX (BFX), a presale project analysts dub the "best crypto presale of 2025" with potential for 100x returns.

Unlike typical presales, BlockchainFX operates a live trading super app integrating stocks, forex, and digital assets. With 10,000 daily users and CertiK-audited smart contracts, it offers USDT rewards yielding up to 90% APY pre-launch. The token price has already climbed from $0.01 to $0.023 during presale, locking in a 5x gain before its $0.05 exchange debut.

Market observers project post-launch targets of $0.10-$0.25, with long-term $1+ valuations predicated on trading revenue growth from $30 million to $1.8 billion by 2030. The project's $500,000 giveaway and Visa card integration further bolster its appeal to retail investors seeking the next Litecoin-style breakout.

Whales Bet Big on Litecoin: 181K Coins in 24H, But Why?

Litecoin has surged into the spotlight as whale activity reaches a fever pitch. Nearly 181,000 LTC tokens were acquired by large holders within 24 hours, signaling a potential bullish turn for the cryptocurrency. The spike in demand coincides with Grayscale's ETF filing and a $100 million treasury purchase by MEI Pharma, now rebranded as Lite Strategy.

Market analysts attribute the frenzy to Litecoin's growing institutional appeal. The token's low transaction fees and proven blockchain infrastructure make it an attractive hedge against Bitcoin's volatility. Santiment data reveals over 1,000 wallets participated in the accumulation spree, creating a strong foundation for upward price momentum.

The Grayscale development marks Litecoin's first serious ETF prospect since Bitcoin's regulatory milestones. Meanwhile, MEI Pharma's strategic pivot underscores corporate confidence in LTC's long-term value proposition. These parallel developments suggest Litecoin may be transitioning from payment token to institutional asset.

Litecoin Whales Accumulate 181K LTC Amid Grayscale ETF Speculation

Litecoin (LTC) is outpacing altcoins with a breakout rally as whales accumulate 181,000 coins in days. The token hit a local peak of $117.47, with 334 whale transactions exceeding $1 million recorded on August 10. Grayscale's filing to convert its LTC Trust into an ETF fuels bullish sentiment.

Grayscale's 2 million LTC holdings could FORM the basis for a new ETF, while an anonymous whale scooped up 36,000 coins. Mid-range holders are also building positions, betting on long-term treasury reserves and institutional adoption.

Is LTC a good investment?

Based on current technical indicators and market sentiment, LTC presents a compelling investment opportunity. The price trading above the 20-day MA at $113.04 demonstrates underlying strength, while whale accumulation of 181,000 coins indicates institutional confidence. The 76% volume surge and ETF speculation provide additional positive catalysts.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $117.22 | Above key support |

| 20-Day MA | $113.04 | Bullish positioning |

| Whale Accumulation | 181,000 LTC | Institutional interest |

| Volume Change | +76% | Strong momentum |

However, investors should monitor the $119.60 resistance level and consider dollar-cost averaging given the MACD divergence.